In this Article, I will be sharing with you how you can verify your Chinese Wholesaler in mainland China.

The first thing would be to verify that the Company of the Wholesaler is registered in Mainland China, the steps to doing that are quick, free and easily verifiable. I have detailed how to verify a Chinese Company on this Article.

However a company can actually exist but they might not be licensed Wholesalers. This means you may be purchasing your product at Consumers price rates if your Chinese Wholesale is a Retailer who is presenting himself as a Wholesaler.

So how can you verify a Chinese Wholesaler? The obvious thing would be the price of the goods. Wholesale prices for the same product are cheaper than Retail prices.

Nevertheless, there are other steps you can take to verify a Wholesaler in Mainland china and we’ll discuss how the system works briefly

Export VAT Tax when buying products from Chinese Wholesalers for delivery in other Countries.

If you are buying products from a Chinese Wholesaler who is shipping that product to another country. This means that the Chinese Whole would be exporting products out of China.

China has a 0% export VAT rate, that means you are not going to be charged any Chinese export VAT taxes. This typically would mean a cheaper price on products.

If your Chinese Wholesaler is requesting that you pay export VAT, then that’s a red flag and you should be suspicious of that Supplier.

In China a legitimate business with a Wholesale licence would be VAT registered.

This is how it works; if a Business has bought products in China and paid VAT taxes on them and used those products in manufacturing the final products which the Business has exported to you as a Customer outside of China. You still don’t get to pay any export VAT tax.

However the Business may get a tax rebate from the Chinese Government for the input tax credit suffered depending on the Business VAT registration status.

In simpler terms, “Tax rebate” means that the Chinese Government pays back to the Business for the VAT tax which the Business pays on products it’s purchased in China which were used in manufacturing the goods exported.

A legitimate Chinese Wholesaler will not charge you export VAT, therefore the price of your product becomes much Cheaper.

An illegitimate Chinese Wholesale, who is not VAT registered and does not have the right paperwork may want to include a fake export VAT to your price or sell you products at a much higher price since they will not be able to get export tax rebate from the Government.

Different between Chinese Export VAT Tax and Sales Tax

As discussed above, while your Chinese export VAT tax is always 0%, you might find other taxes on your price invoice like the Sales tax. So what’s a Sales tax?

If a Chinese Business ships products to you from China to another Country. Your Country can have its own Sales Tax which the Chinese Business may be required to charge you and remit to your Country’s Government for making profit from sales in your Country.

Sales tax rules are complex. they very from Country to Country or even state to state so we can’t dive into the topic of Sales tax in this Article but it’s something to keep in mind.

So for example Assuming; One John from Florida USA orders products from a Wholesaler in China, John will pay 0 Chinese export VAT.

However the Chinese Supplier may charge John US sales tax depending on a number of Factors including John tax status i.e if John is himself a Business with Sales tax exemption in the US, he would not be charged Sales taxes.

VAT tax when buying products from a Chinese Wholesaler for delivery within China.

When you purchase a product from a Wholesaler for delivery within China, you will be required to pay VAT to the Seller.

If the Seller is a legitimate Wholesaler and is VAT registered, they will issue you a VAT fapiao.

To verify your Chinese Wholesaler, you should verify the VAT fapiao issued to you by the seller.

If you are a Chinese registered Business and purchased a product from a Chinese Wholesaler who issues you a VAT fapiao, it’s important to verify it.

If the VAT fapiao a Chinese Wholesaler issues you is authentic, it means that you may be eligible to make VAT deductions, request refund of uncredited input or get export tax rebate from the Chinese Government where applicable.

The VAT Chinese Businesses pay for products which they purchase during the course of their Business operation is called Input Tax and the VAT they charge on the products they sell to customers in China is called Output tax.

Under China’s VAT rules, a business is required to pay to the Chinese Government VAT on the difference between its output tax and its input tax. If the amount of the output tax is insufficient to cover the input tax, the excess (i.e., overpaid input VAT) may be carried forward and offset against output VAT in the next taxable period.

Therefore if you are a Chinese Business and you are paying VAT when purchasing products within China for your Business operation, you need to verify that the Supplier who is charging you VAT for the purchased goods has issued you a correct VAT fapiao.

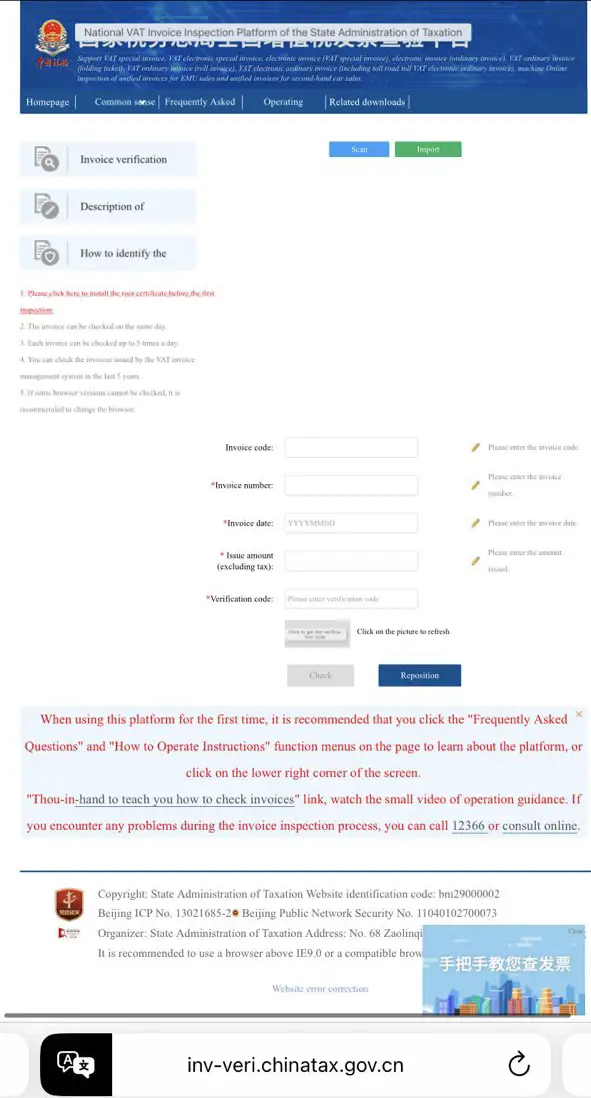

How to verify China VAT e-fapiao invoice

In China, VAT fapiao is a business voucher issued and received by all parties involved in the purchase and sale of goods or services.

VAT e-fapiao, as the name suggests, is a type of fapiao in electronic form. It has the same purpose and legal effect as the conventional paper fapiao.

China VAT fapiao or VAT e-Fapiao is Different from the commercial invoices or receipts used in many other countries mainly to record transactions, fapiao in China serve as both the legal receipt and the tax invoice:

If a Chinese Business charges you VAT, they are required to send you a VAT fapiao which serves as both the legal receipt and the tax invoice:

As a VAT registered business in China you are to verify the Authenticity of the VAT fapiao before paying the VAT charged inorder to be able to make VAT deductions, request refund of uncredited input or get export tax rebate from the Chinese Government where applicable.

You can easily confirm the authenticity of the VAT fapiao issued to you by going to the China Tax verification web page (https://inv-veri.chinatax.gov.cn) entering the details on your VAT fapiao into the required field for verification. The process can be concluded entirely online and is both quick and free.

Remember, these steps can assist you in understanding how the system works and ensuring the legitimacy of Chinese wholesalers .